idaho state capital gains tax rate 2021

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Idaho has enacted several tax cuts in the past decade lowering rates for top earners from a rate of 780 in 2011 down to the current rate of 650 for the 2021 tax year.

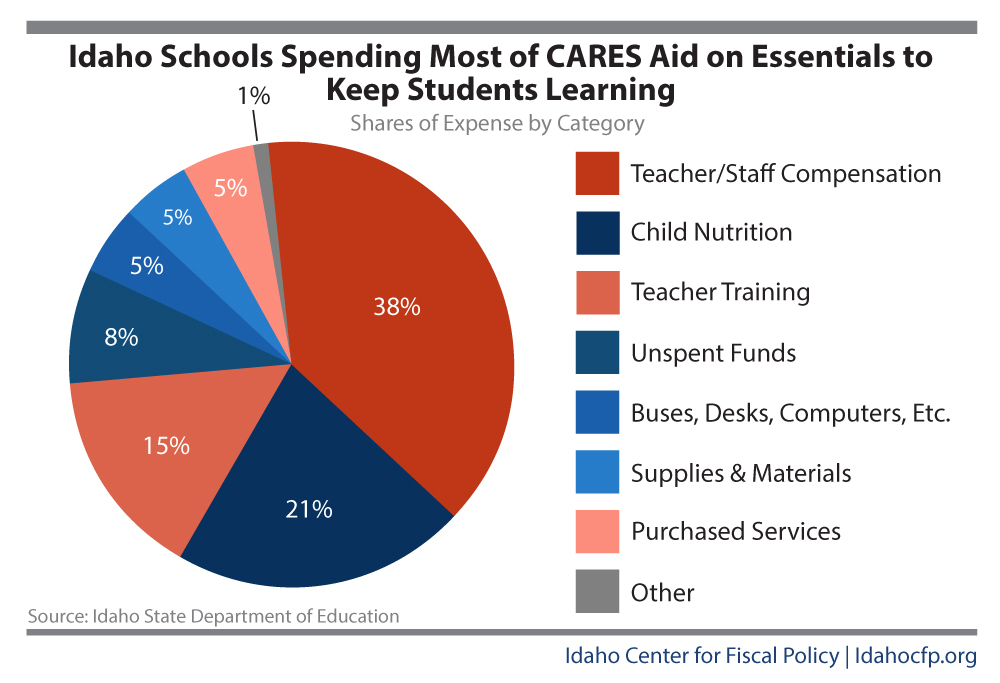

Idaho School Funding Long Term Challenges And Opportunities To Put Students First Idaho Center For Fiscal Policy

This means that Idaho taxes higher earnings at a.

. Combined Rate 3193 Additional State Capital Gains Tax Information for Idaho The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent. Taxes capital gains as income and the rate reaches 575. Hawaii taxes capital gains at a rate of 725.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Tax Rate. Installment sale isnt eligible for the Idaho capital gains deduction if the.

In May 2021 Idaho Governor Brad Little signed into law HB. Individual income tax is graduated. EFO00093 09-15-2021 Form CG Capital Gains Deduction 2021.

Plus 1125 of the amount over. Capital Gains Tax Rate 2021. Idaho conforms to the IRC as of January 1 2021.

For tax year 2001 only the deduction was increased. Taxes capital gains as income and the rate reaches 660. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021.

Plus 3625 of the amount over. If your income was between 0 and 40000. Income tax rates for 2021 range from 1 to 65 on Idaho taxable income.

Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets. If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. Short-term capital gains come from assets held for under a year.

380 which effective retroactive to January 1 2021 lowers the top personal income tax rate from 6925 to 65 reduces the. The 2022 state personal income tax brackets are. Idaho capital gains tax rates.

Plus 3125 of the amount over. Object Moved This document may be found here. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15.

Short-term gains are taxed as ordinary income. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Tax Rate Reduction Effective January 1 2021 all.

Page 1 of 2. Idaho axes capital gains as income. As you know everything you own as personal or investments-.

Idaho doesnt conform to bonus depreciation for assets acquired after 2009. Idaho taxes capital gains as income and both are taxed at the same rates.

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

The Ultimate Guide To Idaho Real Estate Taxes

Idaho Income Tax Rates For 2022

Capital Gains Tax Rates By State Nas Investment Solutions

2022 Capital Gains Tax Rates By State Smartasset

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Gold Silver Bullion Laws In Idaho

Idaho Income Tax Brackets 2020

Ellsworth Vs Silver For Idaho State Treasurer News Journal Com

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Idaho Governor Signs Bill Effectively Banning Most Abortions State Regional Mtexpress Com

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

The States With The Highest Capital Gains Tax Rates The Motley Fool